Market research firm LightCounting recently updated its market report on optical devices for access networks. The report covers FTTx and the application of optical components in wireless front-haul, mid-haul, and back-haul. The report predicts that the global sales of optical devices for access networks will reach 127 million in 2022, with sales of 1.77 billion US dollars. Among them, FTTx devices account for 3/4 of sales and 49% of sales. Fronthaul optical modules accounted for 22% of sales volume and 40% of sales.

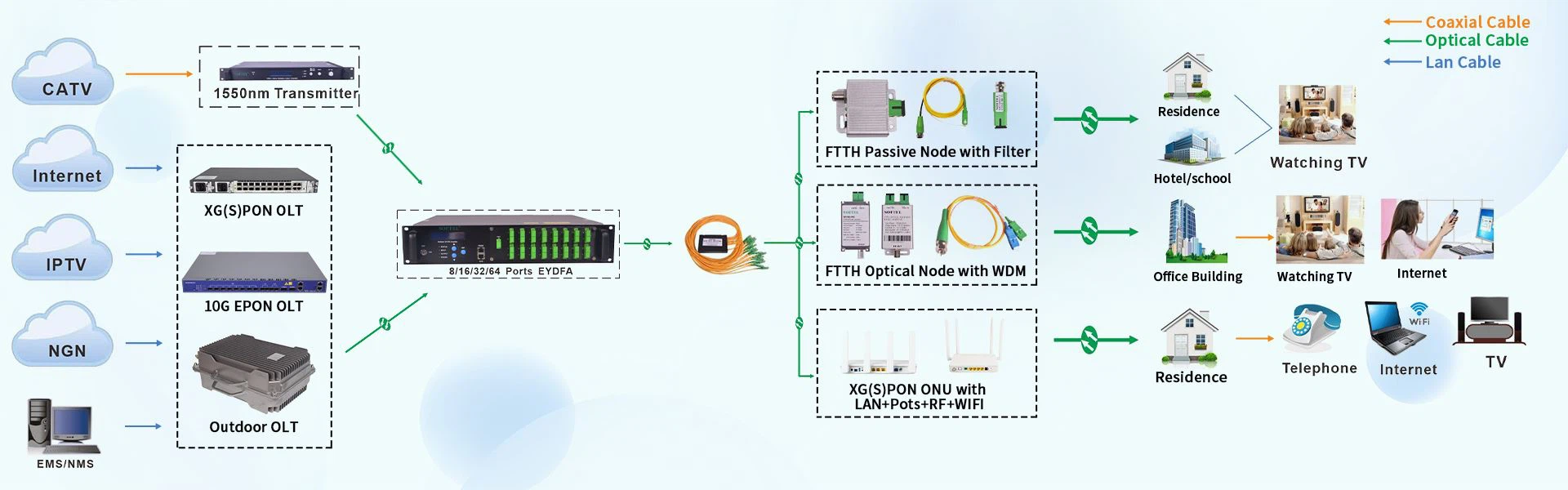

In LightCounting's statistics, PON and front-haul gray light modules have similar weights, occupying the first and second categories. During the forecast period of the report (the next 5 years), sales of optical devices for access networks are expected to increase from 127 million in 2022 to 140 million. Annual sales are projected to be $1.4 billion to $1.6 billion by 2027, after several years of market shrinkage (Figure 1). Both FTTx and wireless front-haul are cyclical markets, and both are technological evolutions from generation to generation. It is expected that the deployment of 6G wireless and 25G/50G PON will appear in the last few years of the forecast period. But in terms of sales, 10G PON modules will still dominate in the next few years (including XG-PON2, XGS-PON, and 10G EPON).

By geographic region, China remains the dominant player in the access network market. Unlike China's government-led infrastructure role, other populous countries rely more on market forces to invest in fixed and mobile broadband. As a result, China was and will remain for the next five years, the single largest national market for wireless and fixed-line access. Figure 2 shows that China's share in this market will always be higher than 50% before 2027.

In the next 5 years, LightCounting estimates that the access network optical device market will reach 7.85 billion US dollars, which is 11% higher than the estimate in April. The main changes come from:

25G and 50G PON Sales Increase Forecast

Forecast of XGS PON Sales Decline

Forecast of increased sales of front-haul gray light modules

Forecast of decline in sales of color light modules