A few days ago, China International Finance Securities pointed out in a research report that according to LightCounting statistics and forecast data, the global Optical Transceiver market will exceed 10 billion US dollars in 2021, and the domestic Optical Transceiver market will account for more than half. In 2022, 400G Optical Transceivers will start to be deployed on a large scale, 800G Optical Transceivers will start to increase in volume, and the demand for high-speed optical chip products will continue to grow.

According to Omdia's forecast for laser chips in data centers and telecom scenarios, the overall market space for optical chips used in 25G and above-rate Optical Transceivers will increase from US$1.356 billion to US$4.340 billion from 2019 to 2025, with a compound annual growth rate of 4.34 billion US dollars. 21.40%.

Looking at the growth of demand for optical chips from the forecast of the Optical Transceiver industry

According to LightCounting's forecast, the global Optical Transceiver market will grow by 4.34% in 2023, and the 4-year CAGR from 2024 to 2027 will be 11.43%.

According to the statistics of CICC Enterprise Credit, the global optical chip market for optical communications in 2021 will be 14.670 billion yuan, of which the market size of 2.5G, 10G and 25G and above optical chips will be 1.167 billion yuan, 2.748 billion yuan, and 10.755 billion yuan, respectively. According to Omdia's forecast for laser chips in data centers and telecom scenarios, the overall market size of optical chips used in 25G and above Optical Transceivers in 2021 will be 1.913 billion US dollars, equivalent to about 13 billion yuan.

Based on the above data, the global communication optical chip market size in 2021 will be about 18-20% of the Optical Transceiver market size. We calculate the corresponding optical chip market size according to the proportion of 18% in the low-end Optical Transceiver market and 20% in the high-end Optical Transceiver market.

At present, the Optical Transceivers with mature product architecture mostly adopt the four-channel structure of PSM4 or CWDM4. 10G and below optical chips roughly correspond to 1G, 10G, 40G Optical Transceivers.

According to the forecast data of LightCounting, the shipments of 1G, 10G, and 40G digital communication Optical Transceivers will start to decline from 2023, and the market size will drop from 614 million US dollars in 2022 to 150 million US dollars in 2027. According to the proportion of 18%, the corresponding optical chip market size will drop from 111 million US dollars in 2022 to 27 million US dollars in 2027.

From the perspective of the evolution of the data center network architecture, the 10G/40G CLOS architecture is outdated. At present, domestic Internet companies are mainly based on the 25G/100G CLOS architecture, and North American Internet companies are beginning to evolve to 100G/400G CLOS and more advanced 800G network architecture.

At present, 100G-800G datacom Optical Transceivers mainly use DFB and EML laser chips with baud rates of 25G, 53G, and 56G. Most of the 800G Optical Transceiver products that have been released so far adopt the 8*100G architecture and use 8 pieces of 56G EML PAM4 optical chips.

According to LightCounting's forecast data, shipments of 25G, 100G, 400G and 800G Optical Transceivers will continue to grow in 2023-2027. The market size is expected to grow from USD 4.450 billion in 2022 to USD 7.269 billion in 2027, at a 5-year CAGR of 10.31%. The corresponding optical chip market size increased from US$890 million to US$1.453 billion.

Wireless backhaul 10G demand is stable, 25G demand is growing

According to statistics from the Ministry of Industry and Information Technology, as of the end of November 2022, the total number of 5G base stations will reach 2.287 million. With the continuous increase in the number of domestic 5G base stations, the growth in demand for 5G base station construction has slowed down. Statistics and forecasts from LightCounting show that global wireless fronthaul 10G and 25G Optical Transceiver shipments will continue to decline from 2022 to 2027.

The market size of wireless fronthaul Optical Transceivers is not expected to pick up until 2026 when Optical Transceivers above 50G are deployed in batches. According to the 5G fronthaul Optical Transceiver optoelectronic chip evolution plan released by IMT-2020, the 25G DFB optical chip can support 50G fronthaul Optical Transceivers based on PAM4.

According to LightCounting's forecast, 50G and 100G fronthaul Optical Transceivers will not drive the 5G fronthaul market to rebound until 2026, and the market size of 25G and above 5G fronthaul Optical Transceivers will stabilize at $420 million from 2023 to 2025. The corresponding 25G and above DFB optical chip market size is about 84 million US dollars.

With the improvement of 5G user penetration rate and the continuous enrichment of 5G applications, the demand for 5G traffic will continue to grow, which will bring about the demand for wireless midhaul and backhaul network expansion. According to the forecast data of LightCounting, the shipment volume of 5G mid-haul and 10G Optical Transceivers will increase from 2.1 million pieces in 2022 to 3.06 million pieces in 2027, with a five-year CAGR of 7.68%. The growing demand keeps the 10G and below Optical Transceiver market basically stable at US$90 million, and the corresponding optical chip market is about US$18.1 million.

In the middle and backhaul market, the demand for 25G, 100G, and 200G Optical Transceivers will maintain rapid growth starting in 2023. The market size of 25G and above medium and backhaul Optical Transceivers will grow from US$103 million in 2022 to US$171 million in 2027, with a five-year CAGR of 10.73%. The corresponding optical chip market size increased from approximately US$21 million to US$34 million.

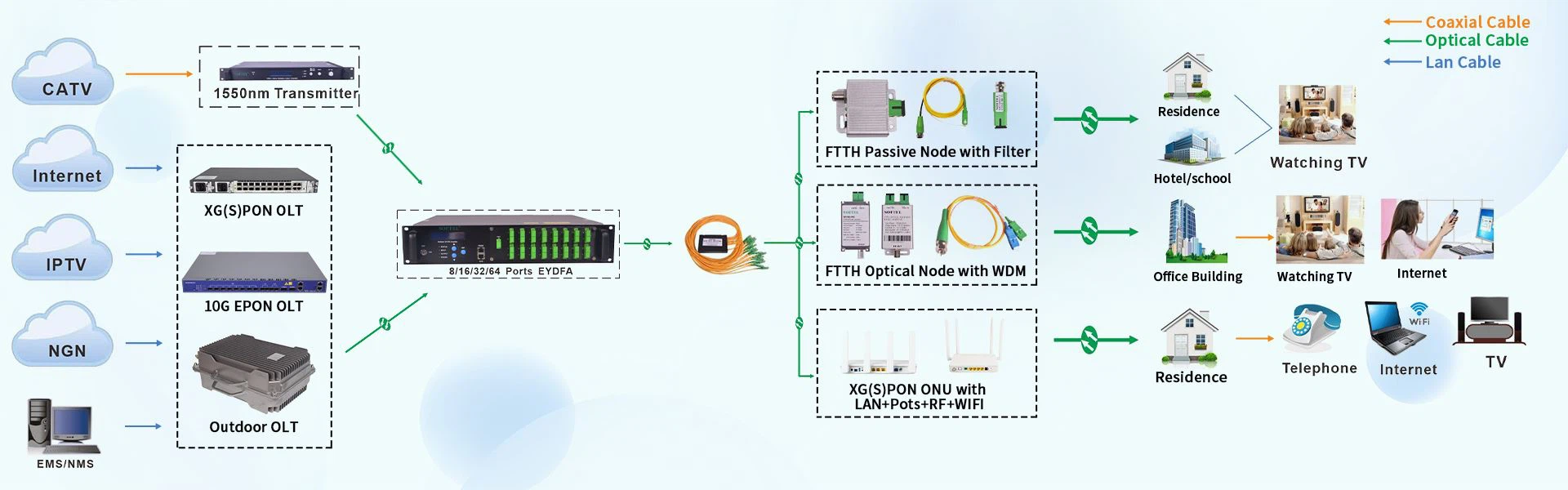

Wired access 10G PON demand continues to grow

According to the "14th Five-Year Plan for the Development of the Information and Communication Industry", during the 14th Five-Year Plan period, my country will fully deploy gigabit fiber optic networks, accelerate the construction of "gigabit cities", continue to expand the coverage of gigabit fiber optic networks, and promote 10G-PON in cities and key towns. Equipment deployment, upgrade of optical access network capacity in old residential areas in cities and towns.

By the end of 2022, the total number of fixed Internet broadband access users of the three basic telecommunications companies will reach 590 million, with a net increase of 53.86 million for the whole year. Among them, the number of users with an access rate of 100Mbps and above was 554 million, with a net increase of 55.13 million for the year, accounting for 93.9% of the total number of users, an increase of 0.8 percentage points compared with the end of the previous year; the number of users with an access rate of 1000Mbps and above was 9175 10,000, with a net increase of 57.16 million for the year, accounting for 15.6% of the total number of users, an increase of 9.1 percentage points compared with the end of the previous year.

According to statistics from the Ministry of Industry and Information Technology, by the end of 2022, the penetration rate of gigabit users in my country will be 15.6%, and there is still a lot of room for improvement. However, the network construction progress of the operator should be ahead of the user development progress.

As of December 2022, the number of 10G PON ports with gigabit network service capabilities will reach 15.23 million, and the gigabit optical network has the ability to cover more than 500 million households. The network scale and coverage level rank first in the world. 10G PON will become the focus of subsequent access network construction.

According to the forecast data of LightCounting, starting from 2022, the shipments of PON Optical Transceivers below 10G will begin to decline. The corresponding market size drops below $200 million.

According to LightCounting forecast data, 10G PON shipments will be about 26.9 million in 2022, and 73 million by 2027, with a 5-year CAGR of 22.07%. The PON market is the largest incremental demand market for 10G optical chips. However, the market size of 10G Optical Transceivers will drop from US$707 million in 2022 to US$287 million in 2027, and the corresponding optical chip market will continue to decline from US$141.4 million to US$57 million.

25G PON and 50G PON, as the next-generation products, will be deployed on a small scale in 2024, and the main deployment period will be after 2025. However, the market size of 25G and above PON Optical Transceivers will exceed 200 million US dollars in 2025, corresponding to 40 million US dollars. The US dollar optical chip market will maintain a year-on-year growth of more than 30% in 2026-2027.